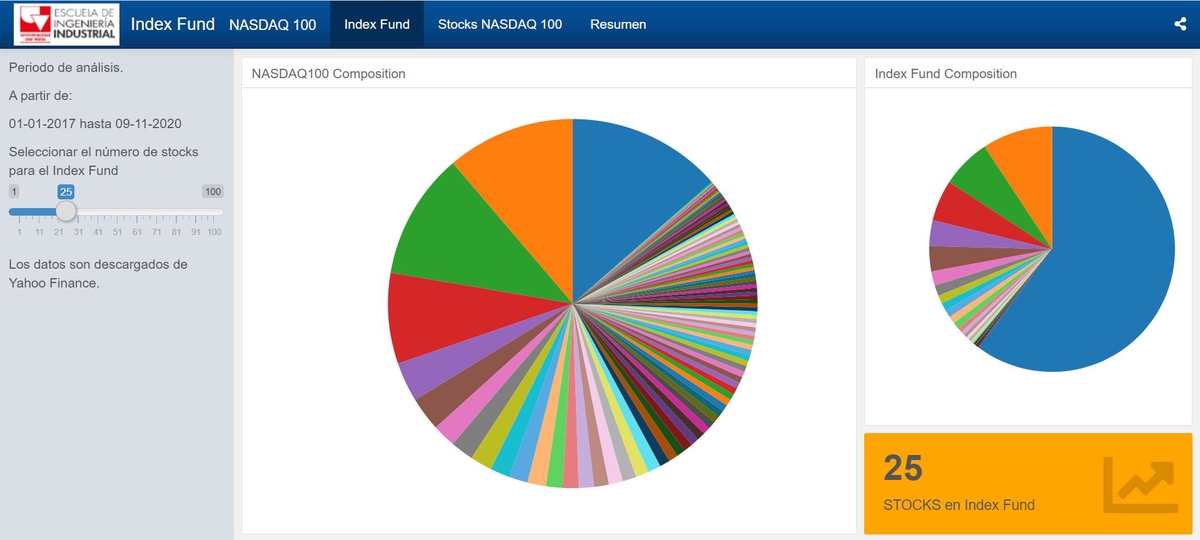

Index Fund to NASDAQ100.

In this post, I present a dashboard that optimizes through an Index Fund the NASDAQ💯.

Visit the app: Index Fund NASDAQ100

Visit the app: Index Fund NASDAQ100Index Fund

An index fund is a portfolio designed to track the movements of a general market population or a market index.

Variables

Objective function

Subject to

Money management strategies are primarily classified as “active” or “passive.”

Active portfolio management seeks to achieve superior performance through the use of technical and fundamental analysis, as well as forecasting techniques.

Passive portfolio management avoids any forecasting technique and relies rather on diversification to achieve the desired performance.

Objective

It is desirable to have an index fund with q stocks, where q is substantially less than the size of the target population (n).

Problem

Create a model that groups assets into similar asset groups and selects a representative asset from each group to be included in the Index Fund’s portfolio.

Approach

Create an Index Fund with q stocks to track the NASDAQ100 index.

Each share i has a share j that represents it in the Index Fund

Each share i can be represented by share j, only if j is in the Index Fund

The objective of the model is to maximize the similarity between the n stocks and their representatives in the Index Fund.